We are providing individual income tax return in Japan for foreigners such as expats / freelance in Japan.

We are very familiar with special topics foreigners such as stock compensation (i.e. RSU, stock options etc) from foreign parent company and dependent deduction for overseas dependents.

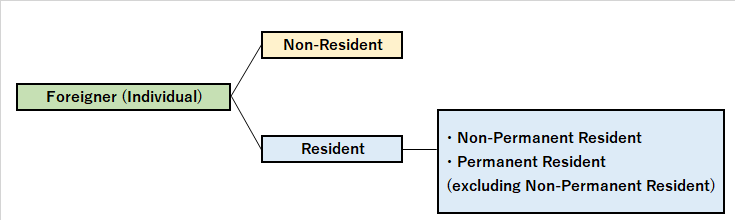

Tax resident status

First of all, you need to check your resident status for individual income tax purpose. Foreigner (Individual) can be categorized to “Resident” and “Non-Resident”. And furthermore, “Resident” is divided to “Permanent Resident” and “Non-Permanent Resident”.

Scope of taxation in Japan is totally different depending on whether which resident status the person belongs to.

Non-Resident or Resident

As above, any individual who has a domicile or owns a residence continuously for one year or more is classified as a “Resident”. And others are “Non-Resident”.

But you have to be careful about the following points.

- If a person who owns a residence in Japan leaves Japan with the intent to be absent temporarily and later reenter Japan, the person shall be treated as having been residing in Japan during the period of absence. The intention to be absent temporarily will be presumed if, during the period of absence, (a) the person’s spouse or relatives remain in the household in Japan, (b) the person retains a residence or a room in a hotel for residential use after returning to Japan, or (c) the person’s personal property for daily use is kept in Japan for use upon return to Japan.

- If a person comes to Japan to work for Japanese company based on one year or more employment contract, the person becomes “Resident” from the time the person enters into this employment contract.

Hence, if you came to japan to work for Japanese subsidiary on 25 June 2020, and secondment contract is for 2 years, you are categorized as “Resident” from 25 June 2020.

As the judgement of which category you belong to is practically quite complicated, we recommend you should ask us to confirm it if you are not sure.

Non-Permanent Resident or Permanent Resident

As above, any individual who has a domicile or owns a residence continuously for one year or more is classified as a “Resident”.

Among “Resident”, any individual of Non-Japanese nationality having domicile or residence in Japan for an aggregate period of 5 years or less within the last 10 years is classified as a “Non-Permanent Resident”.

Resident other than “Non-Permanent Resident” is classified as “Permanent Resident”.

For example, you came to japan to work for Japanese subsidiary on 1 Jan 2018, and you have been living in Japan until 31 Dec 2020. For this case, you are having residence in Japan for 3 years (aggregate period is 5 years or less), so you are categorized as Non-Permanent Resident.

However, if you continue to live in Japan in the future, from 1 Jan 2023, you would be categorized as Permanent resident.

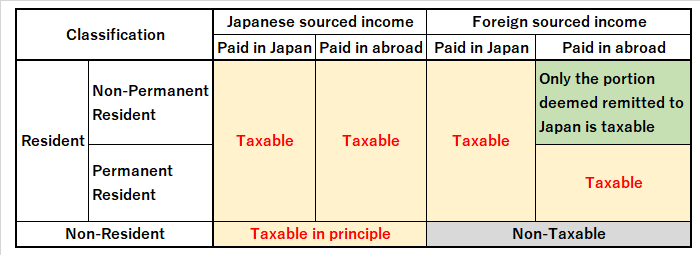

Scope of taxation in Japan for Individuals

For “Non-Resident”, only Japanese sourced income is taxable in Japan. In case of “Non-Permanent Resident”, Foreign sourced income paid in Japan or remitted to Japan is also taxable in Japan in addition to income from sources in Japan. If foreign sourced income is received overseas, and is not remitted to Japan, it would be non-taxable in Japan.

Meanwhile, if you are categorized as “Permanent Resident (excluding Non-Permanent Resident)”, all the income would be taxable in Japan, including foreign sourced income which is not remitted to Japan. This is “Zensekai Shotoku Kazei (全世界所得課税)”.

Hence, as above, it’s most important whether which category you belong to. Here is the summary of scope of taxation in Japan for Individuals.

We will introduce one of tips for individual income tax.

As above, if you are categorized under Non-Permanent Resident for individual income tax purpose, foreign sourced income would be taxable only when it’s deemed remitted to Japan. Hence, as for foreign sourced income such as dividend and capital gain from foreign shares should not be remitted to Japan.

Who should submit individual income tax return?

In case a person has employment income, the person needs to submit individual income tax return in any following case.

- If total amount of annual employment income is exceeding JPY20m

- If the person receive employment income from overseas employer, which is not covered by withholding tax in Japan

- If the person receive employment income from just one employer, and all the employment income is withheld in Japan, and the total of other taxable income (excluding employment income and retirement allowance) is exceeding JPY200,000, and other cases

Hence, if the person receive employment income from only one employer (which is Japanese company and employment income is covered by withholding tax in Japan), and total annual employment income is not exceeding 20m JPY, and does not have any other income, you may not submit individual income tax return in Japan.

If you have receive employment income from overseas employer as well, as it’s generally Japanese sourced income (not Foreign sourced income) , it should be taxable in Japan even if it is not remitted to Japan.

Also, please be careful about vested stock option and RSU granted from foreign parent company. RSU / stock option from foreign company should be deemed as Japanese sourced income, even if you received it outside Japan. But these incomes are not included in withholding income tax, so tax payers need to submit tax return.

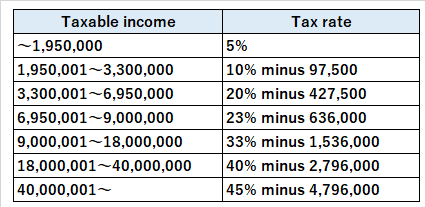

Individual income tax rate

Japanese national individual income tax rate is divided into 7 category (5% to 45%), excluding separate taxation. Japanese national individual income tax rate for 2015 and after is as below.

From 1 January 2013 through 31 December 2037, a surtax known as the Special Reconstruction Income tax (2.1% of standard income tax amount) applies in addition to above national income tax. And local tax (total 10% of taxable income) is separately levied, and enterprise tax will be also levied if you are self employed person.

There are fixed income tax deduction for employment income. Hence, it would be deducted from your annual employment income. Also, social insurance, which was deducted from your monthly salary, is also deducted from income. Also, JPY380,000 basic deduction is added for all tax payers.

“Taxable income” means the net income after these deductions. For other income deduction, please see below.

Main Income deduction & Tax credit

Spouse deduction

Condition: Spouse needs to meet the following 4 conditions as of 31 Dec of each year;

- Spouse should be Spouse regulated in Japanese Civil Law (ex. common-law wife is not included)

- Spouse has to make a living (生計) together with tax payer

- Spouse’s annual taxable net income has to be JPY380,000 or less (from 2020, JPY480,000 or less) (if spouse has only employment income, taxable net income JPY380,000 = annual gross employment income JPY1,030,000)

- Spouse should not be Aoiro Senjuusha (blue tax return) or should not be Jigyou Senjuusha (white tax return)

And from 2018, in case tax payer’s taxable income exceeds JPY10,000,000, tax payer cannot enjoy this spouse deduction.

If tax payer’s taxable net income is JPY10m or less and Spouse’s taxable income is JPY380,001 to 1,230,000 (from 2020, JPY480,001 to JPY1,330,000), tax payer may be able to enjoy spouse special deduction “Haiguusha Tokubetsu Koujo”.

Amount of income deduction

| Tax payer’s taxable net income | Income deduction | |

| Others | Old spouse (60 years or older) | |

| JPY9,000,000 or less | JPY380,000 | JPY480,000 |

| JPY9,000,001 to 9,500,000 | JPY260,000 | JPY320,000 |

| JPY9,500,001 to 10,000,000 | JPY130,000 | JPY160,000 |

Dependent deduction

Condition: Dependent needs to meet the following 4 conditions as of 31 Dec of each year;

- Dependent has to be relatives other than spouse (within 6th degree of relationship by blood & 3rd degree of relationship by affinity) and some other cases might be also accepted

- Dependent has to make a living (生計) together with tax payer

- Dependent’s annual net taxable income has to be JPY380,000 or less (from 2020, JPY480,000 or less) (if dependent has only employment income, taxable net income JPY380,000 = annual gross employment income JPY1,030,000)

- Dependent should not be Aoiro Senjuusha (blue tax return) or should not be Jigyou Senjuusha (white tax return)

- Dependent has to be 16 yeas old or older

Amount of income deduction

| Category | Income deduction | |

| 16 years old (excluding 17 -22, and 70 years or older) | JPY380,000 | |

| 17 – 22 years old | JPY630,000 | |

| Old Dependent (70 years or older) | Not Living in the same place | JPY480,000 |

| Living in the same place | JPY580,000 | |

Deduction for medical expenses (Iryouhi Koujo)

Condition: Medical or dental expenses incurred by a taxpayer or the tax payer’s spouse or family members residing with the tax payer which exceed insurance reimbursements are deductible to the extent they exceed the lesser of JPY100,000 or 5% of the total of the aggregate assessment income, limited to a maximum deduction of JPY2m. Allowable expenses include fees paid to doctors and dentists, payments for medicine, hospital and clinic costs, payments to acupuncturists, masseurs, etc, and payments to nurses and midwives.

Deduction for life insurance premiums, personel pension plan premiums and long-term care (Seimei Hokenryou Koujo)

Condition: Applicable to insurance policies purchased from insurance company with Japanese insurance company.

Deduction for special payments for employee (Tokutei Shishutsu Koujo)

Condition: Applicable to following specific fees paid by employee. (But certificate issued by employer is needed, and applicable in case that the payment amount is huge. In many cases, it’s difficult to apply this deduction. Please let us know, if you did pay a lot the following expenses. We will check if you can enjoy this deduction)

- Training fees in order to get technical skill and knowledege directly needed for your job

- Fees for acquisition of a qualification directly needed for your job

- Other fees borne by employee such as book, entertaiment expenses with clients related to business

Deduction for casualty losses (Zasson Koujo)

A casualty loss deduction may be taken for losses due to natural disasters, theft, embezzlement, etc, of property other than inventories, other business property, forest property and property which is not necessary for ordinary living. Casualties for which the deduction may be taken include damage from earthquakes, storms, floods, snow, cold weather, lightning, noxious insects and man-made casualties such as explosions. If you are resident in Japan, overseas property can also be covered.

The amount of deduction is limited to the amount of the loss (the fair market value of the property damaged or lost plus incidental expenses), less insurance or other compensaton received, reduced by 10% of the total of the taxpayer’s ordinary income amount, retirement income and forestry income. If the loss is caused by a disaster, loss may be reduced by JPY50,000 in lieu of 10% of the total income.

Deduction for a handicapped person (Shougaisha Koujo)

Condition: If the taxpayer is a handicapped person or has a handicapped spouse or dependent relative, a deduction of JPY270,000 per year is allowed for each such handicapped person. If the handicapped person is determined to be a seriously handicapped person, the deduction is increased to JPY400,000. If a seriously handicapped person lives with the taxpayer, the deduction is increased to JPY750,000.

Special tax credit for home acquisition loan

Condition: A credit is allowed to taxpayers whose income for the year does not exceed JPY30m for interest on loans to acquire, build or remodel a house used as the taxpayer’s residence in Japan.

【Additional requirements】Spouse & Dependent deduction for relatives living outside Japan

Do I need to submit any documents when applying for exemption for dependents, etc., for relatives living outside Japan?

With respect to withholding tax at source for salary, public pensions, etc., or the year-end tax adjustment of salary, etc., if a resident applies for an exemption for dependents, a (special) exemption for spouses, or an exemption for people with disabilities (collectively referred to as “an exemption for dependents, etc.”) with regard to non-resident relatives (“relatives residing overseas”), such resident is required to submit or present to the person paying the salary “Documents Concerning Relatives” and “Documents Concerning Remittances” (with Japanese translation if these documents are originally prepared in a foreign language) for the concerned relatives residing overseas.

In addition, if a person claims an exemption for dependents, etc., relating to his/her relatives residing overseas in the final tax return, such person is required to attach “Documents Concerning Relatives” and “Documents Concerning Remittances” to the final tax return, or present such documents when submitting the final tax return. However, if these documents have already been submitted or presented at the time of withholding tax at source for salary, public pensions, etc., or the year-end tax adjustment of salary, etc., to the person paying the salary, they need not be attached to the final tax return or presented.

Note 1: “Documents Concerning Relatives” refer to documents that fall under either (1) or (2) of the following (Japanese translation is required if these documents are originally prepared in a foreign language), and certify that the relative residing overseas is a relative of the taxpayer.

(1) A copy of the supplementary family register or any other document issued by the Japanese government or a local government and a copy of the passport of the relative residing overseas.

(2) A document issued by a foreign country or government (only valid if it contains the name, date of birth, and address or residence of the relative residing overseas).

Note 2: “Documents Concerning Remittances” refer to documents for the year that fall under either (1) or (2) of the following (Japanese translation is required if these documents are originally prepared in a foreign language), and prove that the taxpayer paid for the living expenses or educational expenses of each of the relatives residing overseas as necessary.

(1) A document issued by a financial institution (*) or a copy thereof, that proves that the taxpayer made payment to the relative residing overseas through an exchange transaction executed by the financial institution.

(*) “Financial institution” includes fund transfer businesses as defined under Article 2, paragraph 3 of the “Payments Services Act.”.

(2) A document issued by a credit card company or a copy thereof, that proves that the relative residing overseas purchased goods by presenting a credit card issued by the credit card company and that the amount equivalent to the price for purchasing the goods has been received or will be received from the taxpayer.